DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS,MEANING That I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU. PLEASE READ FULL DISCLOSURE HERE

Are you looking for the best stock research and analysis platform to help you make better investment decisions?

Which one is right for you, Yahoo Finance Plus or Morningstar or Zacks Research or Finviz or Seeking Alpha?

After trying and testing every single one of them, I am going to share with you all the pros and cons of these stock research and analysis platforms to help you save both time and money.

Yahoo Finance Plus

With Yahoo Finance Plus, you can basically do three of the following things:

- Monitor and analyze your investment portfolio

- Find investment ideas

- Do fundamental analysis and research on stocks

If you have an existing investment portfolio, you can easily monitor and analyze your portfolio through your Yahoo Finance Plus by directly connecting to different brokers such as Robinhood, Ally Invest, Interactive Brokers, TradeStation, Fidelity, Etrade, and even Coinbase.

So, what can you do with Yahoo Finance Plus portfolio analytics tools?

Basically, it can help you analyze your investment portfolio in the following four areas:

- Your portfolio performance against different benchmarks such as Dow or Nasdaq or a specific stock over your chosen time period

- Portfolio risk profile (e.g. is your portfolio aggressive or conservative? Yahoo Finance Plus determines your portfolio risk level by looking at its beta as well as its volatility)

- Valuation of your stock holding based on fair value data provided by Yahoo Finance Plus (e.g. you can have a quick overview of how many stocks in your portfolio are overvalued, undervalued, or near fair value)

- How diversified your portfolio is across different industries and sectors (e.g. are you too heavy on technology stocks?)

So, are Yahoo Finance Plus portfolio analytics tools the best in the market?

Personally, I think these tools are very basic.

But if you are looking for more robust and advanced portfolio management and analysis software, I highly recommend Stock Rover (by the way, I use it myself).

Why?

Stock Rover offers so much more in terms of portfolio analysis and management.

It not only provides in-depth portfolio analysis tools, correlation tools, trade planning, and re-balancing facilities, but it also sends you real-time alerts when something happens (to your portfolio) that you need to know.

As investors, you know the importance of portfolio re-balancing to help maintain your target asset allocation.

If you don’t like to do portfolio re-balancing manually, then you can use M1 Finance to help automate your portfolio re-balancing.

Now, let’s move on to check out the other two main features of Yahoo Finance Plus.

On the dashboard, you will see the research reports as well as the fair value of all the stocks that you follow.

Apart from that, you also have a quick overview of the technical chart patterns of the stocks you follow:

- Short term bullish or bearish

- Mid-term bullish or bearish

- Long term bullish or bearish

These ideas are more for short-term traders.

But, if you are a serious day trader or swing trader, there are more advanced and powerful trading software (e.g. Trade Ideas and Trendspider )that you can use to help you find good trading ideas.

If you are looking for new investment ideas, you can also find them inside Yahoo Finance Plus by simply clicking on the tab called “Investment Ideas”.

To make things easier, you can even filter all the investment ideas by ratings, sector, trade type (fundamental or technical), term (short-term, medium-term, or long-term).

Also, for all the investment ideas, you will see its price target.

If you see any interesting stocks that you want to find out more about, you can then dive deep into each one by clicking the stock ticker.

That will show its profile, financial data, valuation measures, historical data, chart, company outlook, and analysis.

Basically, this gives you a general idea of how the company is doing financially.

If you are a serious fundamental investor, then the fundamental and financial data provided by Yahoo Finance Plus might not be good enough for you.

Personally, I use Stock Rover to do all my fundamental analysis on US and Canadian stocks.

Why?

Stock Rover has one of the most powerful stock screeners with over 650 metrics for you to choose from.

To put it in perspective for you, the FREE stock screeners that you can easily find online provide you with much fewer metrics (i.e. less than 100).

Stock Rover’s metrics cover a wide range of areas such as:

- earnings

- growth

- profitability

- financial strength

- capital efficiency

- valuation

- price performance

- momentum

- dividends

- analyst ratings

- stock ratings

Basically, you have ALL the financial and fundamental data on any US & Canadian stocks in one place.

So, when it comes to fundamental analysis, that’s everything you need right there.

Lastly, let’s look at Yahoo Finance Plus pricing.

There are three types of pricing plans:

- Yahoo Finance Essential: $35/month (or $350/year)

- Yahoo Finance Lite: $25/month (or $250/year)

- Free

So, what’s the real difference between Yahoo Finance Plus and the free version?

With the free version, you only get real-time news and stock quotes, multiple linked brokers for portfolio tracking, interactive charts for performance monitoring, and unlimited custom portfolios and watchlists.

By the way, you can get all these free features easily from elsewhere such as Stock Rover’s free plan.

Only when you upgrade to the paid plans, then you can get access to the following:

- Daily trade ideas based on your interests

- Fair value analysis for stocks

- Advanced portfolio performance analysis tools

- Enhanced alerts on stocks that you follow

- Research reports from Morningstar & Argus (Only for Essential)

- Enhanced charting with auto pattern recognition(Only for Essential)

-

Unique company data (Only for Essential)

- Historical financials & statistics with CSV export (Only for Essential)

- Live chat support

So, do I think Yahoo Finance Plus is worth the money?

To answer this question, let’s take a look at Stock Rover’s pricing plans:

- Stock Rover Essentials at $7.99/month (or $6.67/month if billed annually)

- Stock Rover Premium at $17.99/month (or $15.00/month if billed annually)

- Stock Rover Premium Plus at $27.99/month (or $23.33/month if billed annually)

Stock Rover‘s Premium Plus is much more affordable than Yahoo Finance Plus Essential, yet Stock Rover offers much more advanced fundamental analysis tools and features.

Try Out Stock Rover Risk-Free For 14 Days Now (No Credit Card Required)

Yahoo Finance Plus Vs Morningstar Premium

Now, let’s compare Yahoo Finance Plus with Morningstar Premium.

Both Yahoo Finance Plus and Morningstar Premium provide portfolio analytics tools, stock research tools, charting tools and stock research reports.

By the way, the research reports inside Yahoo Finance Plus apparently come from Morningstar analysts.

So, what are the key differences between them?

First of all, Yahoo Finance Plus lets you directly link your brokerage accounts to track and analyze your investment portfolio in real-time, but Morningstar does not have that.

That means you have to manually update your portfolio inside Morningstar.

Another key difference is that Morningstar provides research and ratings on stocks, bonds, mutual funds, and index funds while Yahoo Finance only focuses on stock research and analysis.

Also, when it comes to stock research and stock investment ideas, Morningstar adopts a stock-picking approach that focuses on long-term advantages and intrinsic value while Yahoo Finance broadly covers both stock trading (i.e. technical analysis) and stock investment (i.e. fundamental analysis) in a non-in-depth way.

If you are a fundamental investor who invests in stocks for the long term, then Morningstar will be a better choice than Yahoo Finance.

Inside Morningstar, I find the following ratings the most useful:

- Five Star Stocks (i.e. these companies are all trading below what Morningstar analysts think they are worth)

- Wide Moat Stocks (i.e. the highest-quality companies Morningstar covers)

- Wide Moat & Undervalued Stocks (i.e. High-quality companies at a good price according to Morningstar)

- Wide Moat Focus Index ( i.e. the index is composed of the most undervalued (trading at the lowest current market price/fair value ratios), highest-quality companies)

By the way, Morningstar’s ratings for economic moat capture how likely a company is to keep competitors at bay for an extended period.

Why is it an important characteristic?

It’s because one of the keys to finding superior long-term investments is buying companies that will be able to stay one step ahead of their competitors.

So, the best way to make good use of Morningstar Premium is to go through these stock ratings and picks mentioned above and build a diversified stock portfolio based on them.

Personally, I love a good high-quality company at a discounted price.

That’s why I would put the “Wide Moat & Undervalued Stocks” on my watchlist and add them to my existing stock portfolio whenever I see fit.

Lastly, if you invest in bonds, mutual funds, and ETFs, then you might find Morningstar fund ratings quite helpful.

So, how much does Morningstar Premium cost?

Morningstar Premium memberships are available at the following term lengths and prices:

- $34.95/month

$249/year$199/year (i.e. $16.5/month)

It’s considerably cheaper than Yahoo Finance Plus.

Is Morningstar Premium worth it?

If you are a fundamental investor who invests for the long term, Morningstar Premium is definitely a better and more affordable choice than Yahoo Finance Plus.

You can give Morningstar Premium a try for free for 7 days!

Also, you can take $50 OFF Morningstar Premium if you decide it’s a good fit for you.

[Limited Time Only] Claim Your $50 OFF Morningstar Premium

Yahoo Finance Plus Vs Zacks Research

Now, what about Yahoo Finance Plus vs Zacks Research?

Here’s the key difference between Yahoo Finance Plus and Zacks Research.

Zacks Research is mainly focused on giving recommendations on stock trading picks that would likely go up in the next 30 to 90 days.

So, it’s very short-term oriented.

Now, how does it come up with its trading picks?

How accurate are these trading picks?

Zacks Research uses something called Zacks’ Rank to determine whether the stock would likely go up or down in the next 90 days.

Here’s the idea behind Zacks’ Rank.

According to Zacks’ Founder and CEO, Len Zacks, “Earnings estimate revisions are the most powerful force impacting stock prices.”

So, what that means is that if the stock’s earnings estimate is revised higher, then the Zacks’ rank of the stock will be high.

Conversely, if the stock’s earnings estimate is revised lower, then the Zacks’ rank of the stock will be low.

Now, what does Zacks get all the stocks’ earnings estimates?

It collects and analyzes the stocks’ earnings estimates from all the brokerage analysts that follow the stocks.

Then, it uses a mathematical formula to calculate the Zacks’ Rank of the stock.

There are a total of 5 different ranks:

- Zacks Rank #1 (i.e. Strong Buy)

- Zacks Rank #2 (i.e. Buy)

- Zacks Rank #3 (i.e. Hold)

- Zacks Rank #4 (i.e. Sell)

- Zacks Rank #5 (i.e. Strong Sell)

Basically, these are NOT specific stock trading picks with entry price, exit price, and cut loss point.

It’s just a tool (i.e. Zacks Rank) that you can use to help with your own stock trading analysis.

So, can Zacks Rank really help you make money?

According to its website, it says that it has more than doubled the S&P 500 with an average gain of +23.5% per year from January 1, 1988, to May 4, 2020, with Zacks #1 Rank stock list.

Personally, I find this claim a bit confusing.

First of all, let’s say its subscribers buy the stocks immediately the minute it appears on the Zacks #1 Rank.

Then, when do they sell the stock?

Do they sell it immediately when it gets kicked out of Zacks #1 rank, or when it appears on Zacks #5 Rank (strong sell)?

Let’s say that you have to sell it immediately once the stock’s Zacks Rank is no longer #1.

Depending on how many stocks there are with a Zacks #1 rank as well as how fast the stock’s Rank changes, you might be overwhelmed with all the transactions.

Also, it might be very time-consuming for you as the Zacks Rank is updated daily.

How much does Zacks Premium cost?

It costs $249 per year (i.e. $20.75/month) with a free 30-day trial period.

So, is Zacks Premium worth it?

For Zacks Premium, its short-term stock-picking strategy is essentially based on one single indicator called ” Earnings estimate revisions”.

Do you firmly believe in this trading strategy?

Because that’s basically what you are paying for.

Personally, I think that long-term investing is the way to go for most people unless you are a professional stock trader with a profitable trading system.

Yahoo Finance Plus Vs Finviz

So, how is Yahoo Finance Plus compared with Finviz Elite?

Both Finviz Elit and Yahoo Finance Plus give you financial data, charting, and alerts.

The key difference between them is that Yahoo Finance Plus provides you with portfolio management and analytics tools by allowing you to link to your brokerage account while Finviz Elite does not have this.

You also have the option to get research reports from Morningstar and Argus if you upgrade to Yahoo Finance Essential.

Finviz Elite does not offer you any research reports.

But, Finviz Elite does provide some tools that you won’t find on Yahoo Finance Plus.

For example, Finviz Elite allows you to find all the recent insider transaction data and analyst ratings on the stocks you are interested in.

Also, if you are a trader, you might find the “backtesting” tool useful to backtest your trading strategy. (However, I would recommend Tradingview if you are looking for powerful charting tools and backtesting functions)

With Finviz Elite, you will also get access to the fundamental charts, which are charts based on fundamental data such as EPS and Sales.

With fundamental charts, you will easily see what is the trend in some of the important fundamental data that you are watching for.

For example, has the company’s EPS been rising for the past 10 years?

Or has the company’s EPS been declining for the past 10 years?

Without the chart, you will find it very difficult to visualize the trend with just a bunch of numbers, unless you want to spend time plotting the graph yourself.

Pricing-wise, Finviz Elite costs $39.50/month, but if you pay annually, it would be $299.5/year (i.e. $24.96/month).

Now, let’s look at Yahoo Finance Plus pricing.

There are three types of pricing plans:

- Yahoo Finance Essential: $35/month (or $350/year)

- Yahoo Finance Lite: $25/month (or $250/year)

- Free

In terms of pricing, Finviz Elite is priced similarly to Yahoo Finance Plus.

Personally, I feel that you can find better platforms than both Finviz Elite and Yahoo Finance Plus to meet your investment research needs.

If you are a fundamental investor who likes to dig into company financials, I would recommend Stock Rover because of its comprehensive financial data on both US and Canadian stocks and its powerful stock screener based on fundamental metrics.

But, if you are a value investor, I would recommend Morningstar Premium because it helps you find undervalued high-quality businesses to invest in for the long term.

Yahoo Finance Plus vs. Seeking Alpha Premium

So, how is Yahoo Finance Plus compared with Seeking Alpha Premium?

There are two key differences between Yahoo Finance Plus and Seeking Alpha Premium.

The first difference is that Seeking Alpha Premium offers you unlimited access to expert contributors’ articles and investing ideas, while the second one is that Seeking Alpha Premium offers proprietary ratings on stocks,

Seeking Alpha has many contributors with different backgrounds and experience publishing investing ideas on its website.

These contributors are not employed by Seeking Alpha, but quite a number of the contributors are leveraging Seeking Alpha’s platform to promote their own products (e.g. subscription-based investment services) of which Seeking Alpha takes a percentage of the sales as well.

So, are these contributors good?

Is it worth subscribing to Seeking Alpha Premium to read their articles?

These contributors have specialized knowledge and experience in their respective fields such as value investing, high-growth stocks investing, REITs investing, commodity trading, or dividend stock investing.

What I like most about Seeking Alpha Premium is that you will get to read both the bullish case as well as the bearish case presented by different expert contributors.

Investing comes with risk.

So, I really love going through the bearish case on the stocks that I want to invest in or already hold in my portfolio.

It can give me a fresh perspective and help me understand and evaluate the risks involved.

Now, let’s move on to the second difference between Yahoo Finance Plus and Seeking Alpha Premium.

There are three types of ratings provided by Seeking Alpha Premium:

- Quant Rating

- Seeking Alpha Authors Rating (i.e. ratings given by Seeking Alpha article contributors)

- Wall Street Rating (i.e. ratings given by Wall Street equity analysts)

Quant rating is derived by comparing over 100 metrics for the stock to the same metrics for the other stocks in its sector.

These metrics include the company’s financial data, stock price performance, and analysts’ estimates of future revenue and earnings.

Essentially, the Quant Rating evaluates the stock in relation to its peers in the same sector, not the rest of the stock market as a whole.

There are five types of Quant ratings:

- Strong Sell (i.e. a score of 1)

- Sell (i.e. a score of 2)

- Hold (i.e. a score of 3)

- Buy (i.e. a score of 4)

- Strong Buy (i.e. a score of 5)

So, how is Quant Rating being calculated?

They derive Quant Rating by looking at the following five “Factor Grades”:

- Value

- Growth

- Profitability

- Momentum

- EPS Revisions

To determine the Factor Grade, the relevant metrics for the factor for the stock are compared to those for the other stocks in the same sector.

Then, that factor is assigned a grade of A+ to F.

By the way, Quant Rating is NOT an average of the five “Factor Grades”.

Instead, some Factor Grades might be given a greater weighting.

Here’s an example of what Quant Rating Breakdown looks like inside Seeking Alpha Premium.

So, can Quant Rating help you invest better?

There is no actual performance track record for Seeking Alpha’s Quant Rating.

But, the performance results shown on the Seeking Alpha website come from a backtest (i.e. testing the trading strategy based on historical data).

So, how have Seeking Alpha’s Strong Buy Recommendations compared against the S&P 500?

Do take note that the performance is based on backtesting.

From 2010 to March 2024 (as of my writing), Seeking Alpha Strong Buy achieved a total return of $245,380 based on $10,000 in investment capital while the S&P 500 achieved a total return of $51,032.

The back-test results certainly look very impressive.

Personally, I would recommend you to try out the “Strong Buy” recommendations by Seeking Alpha. It’s suitable for both stock investors as well as traders.

For Seeking Alpha, there are three types of pricing plans:

- Basic: Free

- Seeking Alpha Premium:

$239/year$189/year - Seeking Alpha Pro: $2400/ year (mostly for professional traders)

Right now, there is a free 7-day trial for you to test drive it and see if it works for you. If you decide to get it, there is a special $50 discount for you by using this link.

Limited Time: Claim Your Free Trial of Seeking Alpha Premium

If you don’t have time to do your own stock research, one of the stock investment newsletters that I have been subscribing to is Motley Fool Stock Advisor which makes specific stock recommendations for long-term portfolio growth.

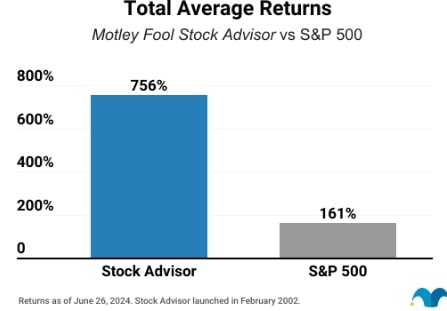

Below is the performance comparison between Motley Fool Stock Advisor and S&P 500 between 2002 and 26 June 2024.

As of 26 June 2024, average Motley Fool Stock Advisor recommendations have returned over 756% since inception while the S&P 500 has returned 161%.

In short, the Motley Fool Stock Advisor has outperformed the market 4 to 1.

But, what about its individual stock picks?

This metric is important because I might not be buying every single stock recommendation made by the Motley Fool Stock Advisor.

Below is a table that shows you the performance of individual stock picks over the years.

As of 6th September 2023, Motley Fool Stock Advisor has had 173 stock recommendations with 100%+ returns.

[Past performance is no guarantee of future results. Individual investment results may vary. All investing involves risk of loss.]

The difference between Motley Fool Stock Advisor and Seeking Alpha is that Motley Fool’s track record is based on actual results, not back-testing.

So, how much does Motley Fool Stock Advisor cost?

Usually, its annual subscription is $199.

Right now, there’s a special limited-time 50% OFF offer* for new members for the first year when you click the link here to try it out for 30 days with a Membership-Fee-Back Guarantee. (*Billed annually. Introductory price for the first year for new members only. First-year bills at $99 and renews at $199)

So, for $99 a year- that’s just $1.80 a week – you can gain unlimited access to their library of expert stock recommendations which are carefully selected to help you grow your wealth.

Lastly, in terms of pricing, Seeking Alpha offers three types of pricing plans:

- Basic: Free

- Seeking Alpha Premium:

$239/year$189/year - Seeking Alpha Pro: $2,400 per year

Yahoo Finance also has three types of pricing plans:

- Yahoo Finance Essential: $35/month (or $350/year)

- Yahoo Finance Lite: $25/month (or $250/year)

- Free

For stock research and analysis, I would say Seeking Alpha Premium is a much better option than Yahoo Finance because it gives you more value (ratings, bull say vs. bear say, stock screener, etc.) at a cheaper price.

[Limited Time Only] Claim Your $50 OFF Seeking Alpha Premium & Try It For 7 Days Free

I enjoyed your post. I too have tried all of the platforms you mentioned. The thing that gets me every time is user interface and whether there is a mobile App. I wanted to like Stock Rover, but to me the interface online is way too cluttered and it’s hard to use. It also does not have a mobile app at all. I like Seeking Alpha and Yahoo Finance as they both have decent interfaces and available on my mobile device. I am just trying out Benzinga too. If that had a better portfolio management tool that was available on the app and you could enter positions manually, then I think that would be the best of the bunch. Morningstar has a portfolio management section online, but it is very cumbersome. For a look at my entire portfolio, I like Seeking Alpha or Yahoo Finance. I don’t think I could use just one of those though.