DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS,MEANING That I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU. PLEASE READ FULL DISCLOSURE HERE

Which is better, Motley Fool or Morningstar? I have been using both Morningstar and Motley Fool for years, so let me share with you a very detailed comparison between Motley Fool and Morningstar to help you make an informed decision.Motley Fool

The Motley Fool has been around for almost 30 years and is one of the leading financial publishers in the world. It also offers a wide range of stock-picking services, with its most popular one called “Motley Fool Stock Advisor”. With Motley Fool Stock Advisor, you would get specific stock recommendations every single month with detailed analysis. So, what investment strategy does the Motley Fool use to pick stocks?

To put it simply, they “invest in great businesses, not stock tickers”, especially great businesses that have huge growth potential and are poised to be the market leader in the future.

And they only want to invest in businesses that they think will do well in the next three to five years and beyond.

Here are just some of the criteria they look at:

So, what investment strategy does the Motley Fool use to pick stocks?

To put it simply, they “invest in great businesses, not stock tickers”, especially great businesses that have huge growth potential and are poised to be the market leader in the future.

And they only want to invest in businesses that they think will do well in the next three to five years and beyond.

Here are just some of the criteria they look at:

- Competitive advantage

- Market Opportunity

- Strength of leadership

| Motley Fool Stock Advisor | |

| Pros | Cons |

|

|

Morningstar

Now, what about Morningstar? Morningstar has been around since 1984, and it’s a well-known investment research company that performs analysis on stocks, bonds, exchange-traded funds, and mutual funds. For individual investors, “Morningstar Investor” gives you access to all its analysts’ ratings and estimated fair value, research reports on stocks, bonds, and funds, a stock screener, portfolio management tools, and charting tools. So, how exactly does Morningstar rate stocks?

Morningstar adopts a stock-picking approach that focuses on long-term advantages and intrinsic value.

To help you gauge whether or not a company has “long-term advantages” over its competitors, Morningstar provides you with economic moat ratings for each stock.

There are three types of economic moat ratings:

So, how exactly does Morningstar rate stocks?

Morningstar adopts a stock-picking approach that focuses on long-term advantages and intrinsic value.

To help you gauge whether or not a company has “long-term advantages” over its competitors, Morningstar provides you with economic moat ratings for each stock.

There are three types of economic moat ratings:

- Wide (i.e., highest moat rating)

- Narrow

- Non

So, companies with the highest moat rating have the most sustainable competitive advantages and, thus the greatest potential for future price appreciation.

Morningstar’s Star Rating gives you an idea of the stock’s current valuation.

In other words, it tells you whether the stock is above its fair value, below its fair value, or near fair value.

It’s calculated by comparing a stock’s current market price with Morningstar’s estimate of the stock’s fair value.

To get rated 5 stars, the stock must be trading meaningfully below the estimated fair value that is calculated by Morningstar’s analysts. To help you understand better its rating system, a 3-star rating means the stock is trading near the estimated fair value, while a 1- and 2-star rating means the stock are trading meaningfully above the estimated fair value. You can give Morningstar Investor a try for free for 7 days! Also, you can take $50 OFF Morningstar Investor if you decide it’s a good fit for you.Morningstar also provides Fund Ratings ( ETFs and mutual Funds) for investors who want to compare and choose which fund is the most suitable one for them.

Morningstar evaluates funds based on five key pillars (i.e. Performance, Process, Price, People, and Parent) to determine if they are more likely to outperform over the long term on a risk-adjusted basis.

Morningstar gives funds one of the following Medalist Ratings:- Gold

- Silver

- Bronze

- Neutral

- Negative

| Morningstar | |

| Pros | Cons |

|

|

Motley Fool Vs Morningstar: Product

What is the key difference between the Motley Fool Stock Advisor and Morningstar Investor? Motley Fool Stock Advisor gives specific stock recommendations while Morningstar is a stock research and analysis platform to help you find stock ideas and also research stocks by providing you with its proprietary stock ratings and analyst’s independent research reports on stocks, bonds, ETFs, and mutual funds. Here’s exactly what you get as a Motley Fool Stock Advisor member:- You will receive two stock recommendations every month (one stock recommendation on the first Thursday and the other on the third Thursday of the month). Each new stock recommendation comes with a full analysis of the opportunities and risks

- The current Top 10 Favorite Investment Opportunities are released on the second Thursday of every month

- 10 Foundational Stocks for new investors (regularly updated)

- 5 Exchange-Traded-Funds

- You will receive a real-time email notification when it’s time to sell, so you are never left wondering what to do

- You gain instant access to all past Motley Fool’s Stock Advisor recommendations

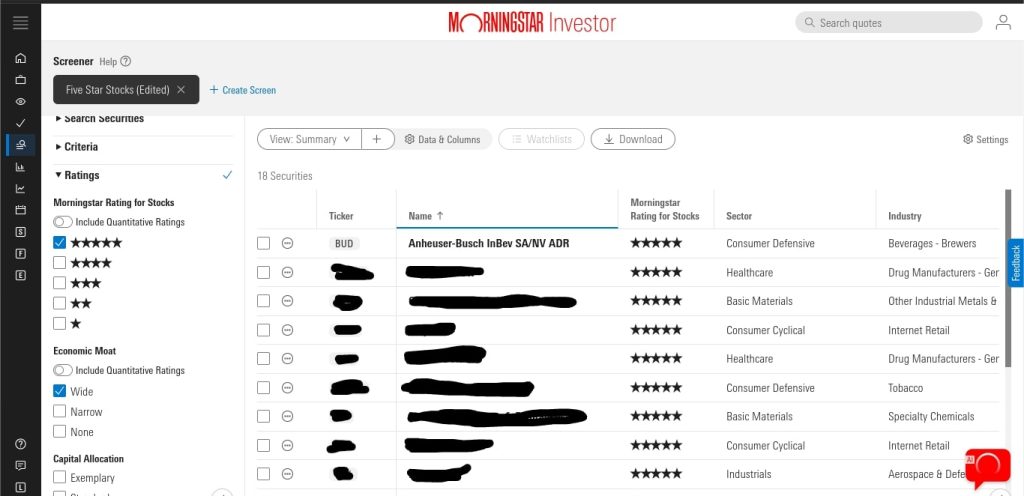

Personally, I like to use Morningstar to find stocks that have a wide moat and are currently undervalued.

Using the Morningstar Investor stock screener as shown below, you can choose a Wide Moat Rating and a Star Rating of 5 stars under “Ratings”.

There are other criteria, such as Industry, Sector, Market Cap, Valuation, Profitability, and Dividend that you can customize.

But, it’s quite limited compared to Stock Rover‘s fundamental stock screener.

Basically, I only find Morningstar ratings very useful.

On top of that, you can also use the Morningstar platform to research and analyze stocks.

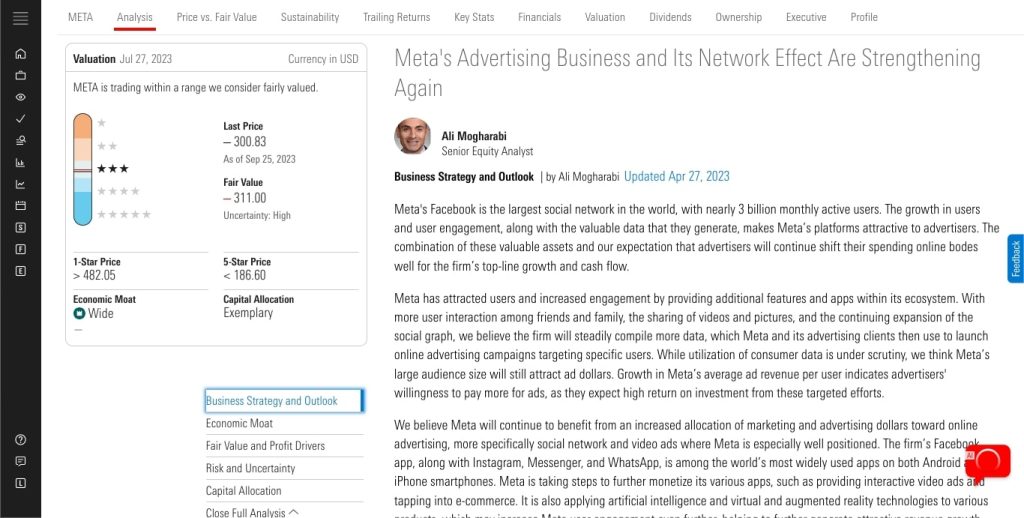

For example, if Meta is one of the stocks on your watchlist, it would be helpful to know what Meta’s current estimated fair value is, how its business is doing, and potential risks.

On top of that, you can also use the Morningstar platform to research and analyze stocks.

For example, if Meta is one of the stocks on your watchlist, it would be helpful to know what Meta’s current estimated fair value is, how its business is doing, and potential risks.

Morningstar does NOT tell you exactly what stocks to buy and when to buy and when to sell, but you can use its stock ratings and analysts’ research reports to help you make investment decisions.

Since they give you an estimated fair value for every stock, it’s reasonable to assume that it would give you a good margin of safety as long as the current share price is below the estimated fair value.

Lastly, if you are interested in investing in mutual funds and ETFs, Morningstar helps you choose the most suitable ones by providing you with ratings.

Morningstar does NOT tell you exactly what stocks to buy and when to buy and when to sell, but you can use its stock ratings and analysts’ research reports to help you make investment decisions.

Since they give you an estimated fair value for every stock, it’s reasonable to assume that it would give you a good margin of safety as long as the current share price is below the estimated fair value.

Lastly, if you are interested in investing in mutual funds and ETFs, Morningstar helps you choose the most suitable ones by providing you with ratings.

Motley Fool Vs Morningstar: Performance

In terms of the past performance of stock recommendations, Motley Fool Stock Advisor has a proven track record with its stock picks outperforming the S&P 500 for the same period since its inception. As of 4th December 2024, average Motley Fool Stock Advisor recommendations have returned over 929% since inception, while the S&P 500 has returned 178%. This performance might be a little misleading because its earlier ( i.e., 10-20 years ago) stock recommendations, such as Amazon, have extremely high returns. This could skew the average return upwards. As for Morningstar, it doesn’t give you specific stock picks, so there is no track record of how Morningstar ratings have been performing compared to the S&P 500. However, there is an ETF called “VanEck Morningstar Wide Moat ETF” which seeks to replicate as closely as possible, before fees and expenses, the overall performance of attractively priced companies with sustainable competitive advantages according to Morningstar’s equity research team. As you can see, this Morningstar Wide Moat ETF has performed quite well over the years.

I highly recommend Morningstar if you are an investor who does your own stock research.

As you can see, this Morningstar Wide Moat ETF has performed quite well over the years.

I highly recommend Morningstar if you are an investor who does your own stock research.

Leave a Reply